stock option exercise tax calculator

Ordinary income tax and capital gains tax. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Including trades quotes aggregates and reference data.

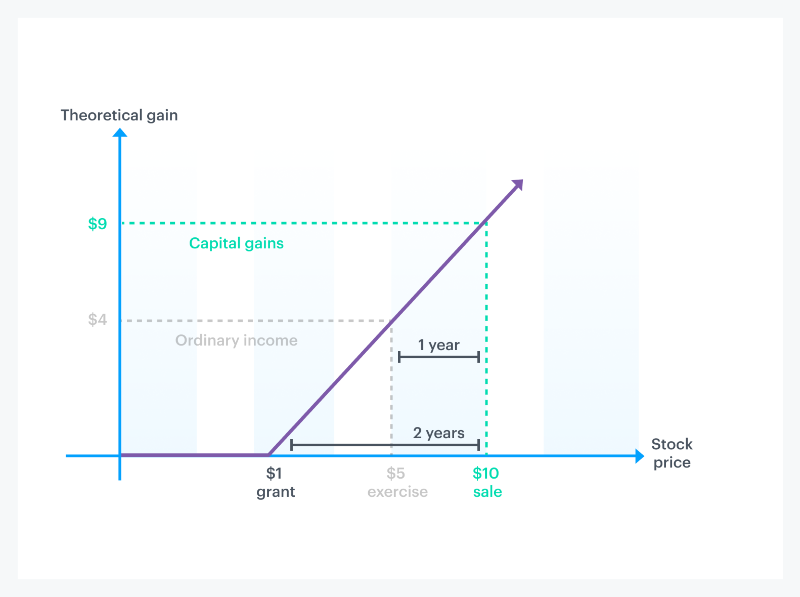

. There are two types of taxes you need to keep in mind when exercising options. In our continuing example your theoretical gain is. More on tax considerations below.

Ad Receive a free funding offer to cover all your option exercise costs including tax. Fair market value when. In the second year 500 and so on until full vesting after the fourth year and the employee can.

Holders of non-qualified stock options NSOs are subject to tax at exercise if the fair market value of the stock is higher than the exercise price spread. The terms of the Option Grant specify that. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. Taxes Due at Exercise.

Ad Instant access to real-time and historical options market data. Open an Account Today. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Ad Trade your view on equity volatility with VIX options and futures.

If you leave a company and. On this page is an Incentive Stock Options or ISO calculator. If you want a personalized figure use our Stock Option Tax Calculator.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Since the stock price starts at 5 on the date of grant and then rises to 8 a share at the time of exercise theres an embedded gain of 3 per NSO. Get side-by-side comparisons of different plans for your equity in 10 minutes or less.

Remember that there are tax implications to exercising your stock options. Ad Receive a free funding offer to cover all your option exercise costs including tax. On this page is a non-qualified stock option or NSO calculator.

This benefit should be reported on the T4 slip issued by your employer. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. 3 Strategies To Consider When You Exercise Your Stock Options.

Ad Fidelity Offers Private and Public Companies Decades of Equity Plan Experience. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. Your taxes will be paid on 10 minus 5 equaling 5 per share of income aka 50000 of taxable gain.

Exercise incentive stock options. It requires data such as. The taxable benefit is the difference.

Ad Access Free Self-Paced Trading How-Tos. After the first year the option holder can exercise options on 250 shares. When you exercise your employee stock options a taxable benefit will be calculated.

The options were granted within 10 years of the adoption of the Stock Option Plan and within 10 years of approval by the stockholders of the grantor. Example of an Incentive Stock Option Exercise Disqualifying Disposition Shares Sold Before Specified Waiting Period. You will only need to pay the greater of.

Just create an account enter your tax and equity details and it runs the. You can find your federal tax rate here. Net Value After Taxes.

Incentive stock option iso calculator. Calculate the costs to exercise your stock options - including taxes. The results provided are an.

Tax Planning For Stock Options

Stock Options For Startups Founders Board Members Isos Vs Nsos

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

When To Exercise Stock Options

Taxation Of Stock Options For Employees In Canada Madan Ca

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Video Included What Is An Employee Stock Option Mystockoptions Com

Taxation Of Stock Options For Employees In Canada Madan Ca

Employee Stock Options Financial Edge

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Employee Stock Option Software Global Shares

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)